The Wall Street Journal featured the grocery chain Kroger in an article yesterday titled, COVID-19 Vaccinations, Tests Give Boost to Kroger’s Health Ambitions.

“With 2,250 pharmacies and 220 clinics largely in the Midwest and the southern U.S., Kroger is the fourth-largest pharmacy operator by script count,” the Journal noted, adding details about Walmart, CVS Health, and Walgreens all fast-expanding their respective health care footprints.

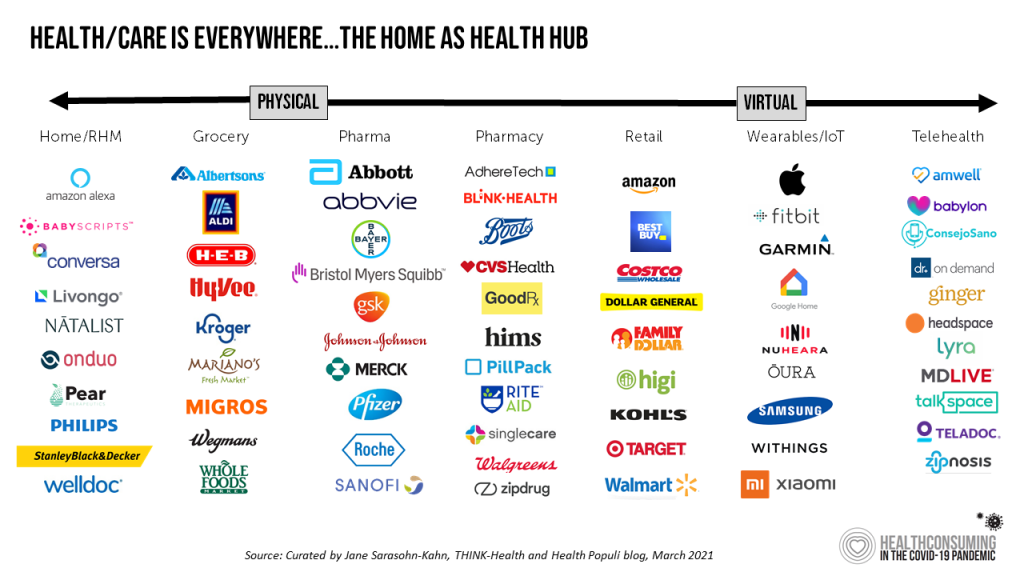

As more consumers view their homes as personal and safe health havens, there is no shortage of suppliers in the food, retail, and mobility sectors working fast to meet that demand for convenient and accessible services. The pace of market signals happening in medical and wellness over the past month bolsters the trend that many consumers are shifting their focus of a preferred site of health care from brick-and-mortar health care providers and systems to places closer to home or at-home — via retail-, community- and home-based services.

It was the COVID-19 pandemic that accelerated some early-adopting health consumers viewing their home as their ultimate site for self-care and health care. This trend was already in motion at the start of 2020, after which the public health crisis raised patients-as-consumers’ awareness and value of hygiene, food-for-immunity, and physical distancing.

It was the COVID-19 pandemic that accelerated some early-adopting health consumers viewing their home as their ultimate site for self-care and health care. This trend was already in motion at the start of 2020, after which the public health crisis raised patients-as-consumers’ awareness and value of hygiene, food-for-immunity, and physical distancing.

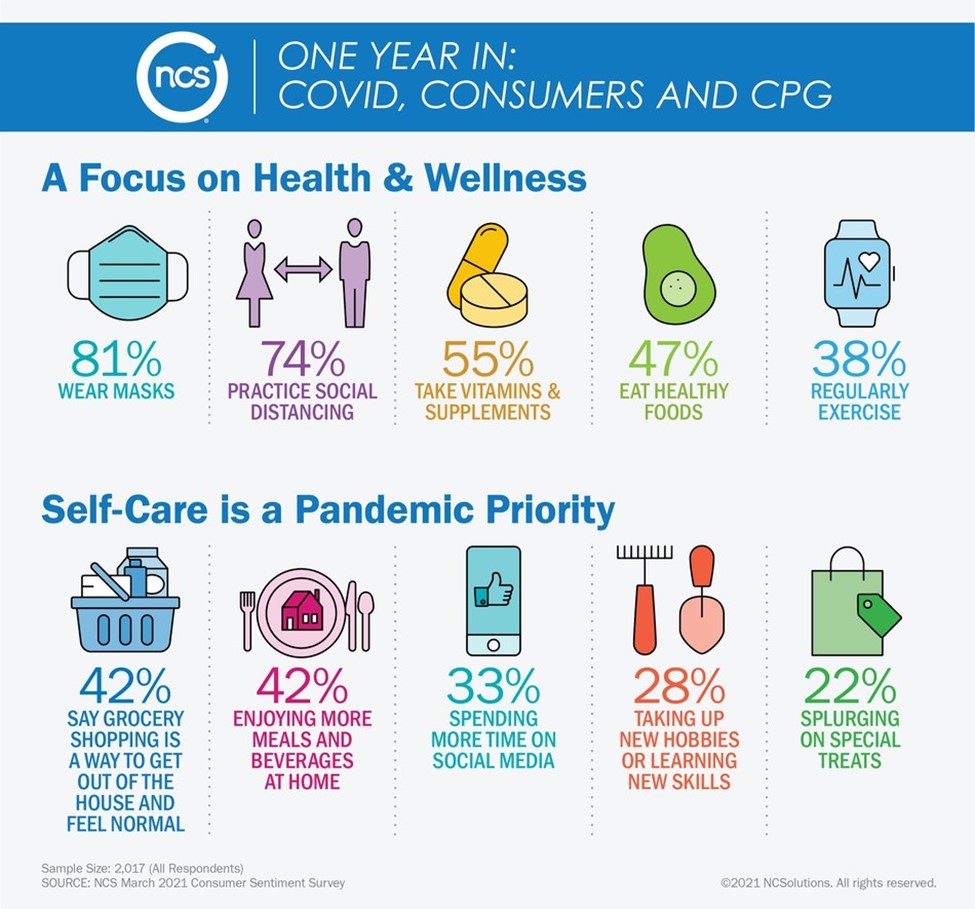

New data from NCSolutions (NCS) polled 2,017 U.S. consumers in March 2021 on perspectives one year into COVID. The first chart tells you that 4 in 5 Americans were wearing masks, three-fourths practicing social distancing, and one-half taking vitamins and supplements and eating healthy foods to boost wellness.

“Self-care is a pandemic priority,” NCS intuited from their data.

In the pandemic era, self-care for emotional wellness including watching TV and movies (for 69% of Americans), enjoying more food and beverages at home (42%), spending more time on social media (33%), and another one-third of people ordering takeout or delivery from restaurants.

The pandemic pantry also finds most U.S. consumer stocking up on cleaning supplies, toilet paper, self-stable foods (like rice, pasta, and beans), proteins, fresh fruits and vegetables, and…health care items (among 63% of U.S. consumers). THINK: over-the-counter painkillers, thermometers, cold and flu meds, and allergy products.

To that end, note that Instacart experienced their shoppers turned to vitamins and supplements to boost immunity to defend against a “twindemic” of COVID-19 and flu-cough-cold concerns.

Diving further into U.S. consumers’ self-care trends, IRI has been tracking peoples’ retail behaviors during the coronavirus pandemic since the first quarter of 2020. At the start of 2021, over one-third of people started the new year with heathy eating and exercise goals, along with more economizing to save money.

Diving further into U.S. consumers’ self-care trends, IRI has been tracking peoples’ retail behaviors during the coronavirus pandemic since the first quarter of 2020. At the start of 2021, over one-third of people started the new year with heathy eating and exercise goals, along with more economizing to save money.

In their analysis on the “changing shape of the CPG demand curve,” found that consumers continue to seek products to support immunity and reduce stress, anxiety, and fatigue/sleep.

Growing numbers of consumers are looking at health more holistically — physical and mental wellness together — and spending money on goods to support that goal.

Beyond overall wellness, though, consumers are also turning more to food and beverage (F&B) purchases for chronic illness support: for example, U.S. consumer purchases on F&B products that provide diabetes support grew 37% between March and April 2020 and 14% between May and December 2020; products that provide obesity support expanded 48% in the March-April period and 13% in the May-December interval; and, F&B products that provide hypertension support grew 40% between March-April and 9% between May-December.

On a recent call explaining ecommerce trends in wellness, Brian Owens of VMLY&R explained shifts in consumer spending fueled by lifestyle changes — “any activity” from home, fewer and shorter trips to stores, and holistic wellness.

On a recent call explaining ecommerce trends in wellness, Brian Owens of VMLY&R explained shifts in consumer spending fueled by lifestyle changes — “any activity” from home, fewer and shorter trips to stores, and holistic wellness.

One of the major changes due to the pandemic and quarantine behavior was consumers adapting to shopping across retailers’ ecosystems — if not in brick-and-mortar stores, then more “BOPIS” — buying online, picking up in store — along with more social commerce (say, via Instagram or TikTok), video commerce, and the emerging interface of commerce via AR/VR with which Ikea has experimented for several years.

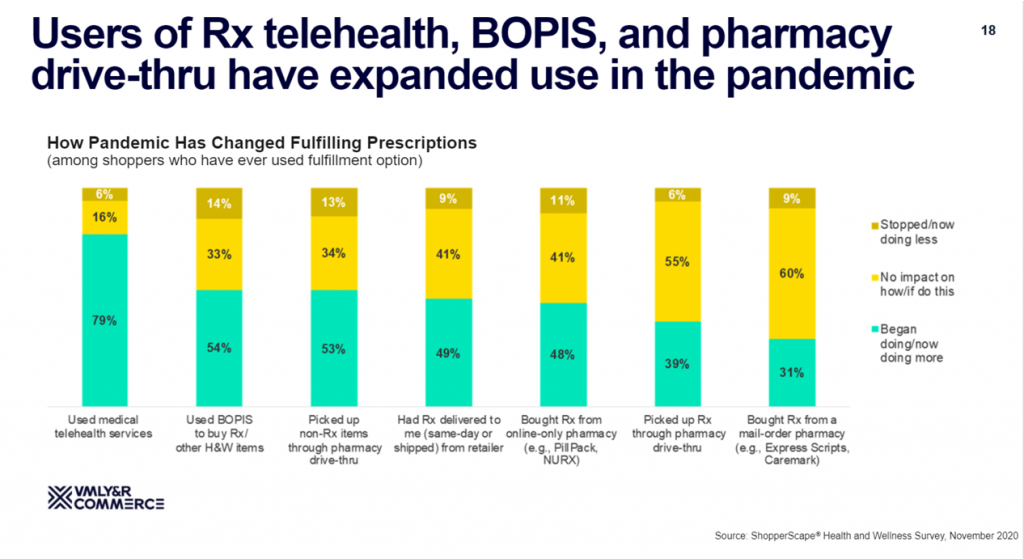

Brian presented this vertical bar chart illustrating consumers’ pandemic-era utilization of telehealth, Rx delivery, pharmacy purchases online, among other expanding pharmacy shifts occurring by November 2020.

These pharmacies can be co-located with grocery store chains, Big Box stores, or be morphing into vertically integrated health/care delivery organizations like CVS Health or Walgreens-Village MD.

These pharmacies can be co-located with grocery store chains, Big Box stores, or be morphing into vertically integrated health/care delivery organizations like CVS Health or Walgreens-Village MD.

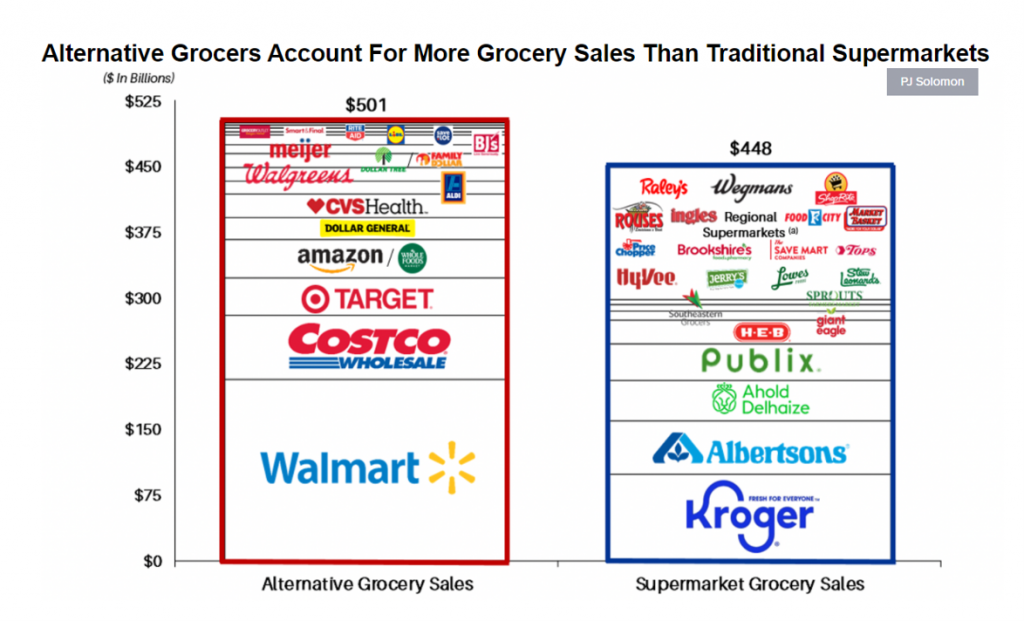

The investment bank PJ Solomon focuses on these industry sectors, paying attention to trends impacting the companies operating in these markets.

They identified a shift happening in U.S. consumers’ grocery purchases from traditional supermarkets (including operating pharmacies) compared with grocery sales from “alternative grocers” — namely Walmart, Costco, Target, Amazon, Dollar General, CVS Health, and Walgreens, among others.

This chart shows you the impact of these newer-fangled retailers selling food, and other goods — with collective grocery sales exceeding those of supermarkets.

Health Populi’s Hot Points: As we continue to forecast and develop strategies to meet health consumers’ demands in and beyond the COVID-19 pandemic, it’s not just “all about Amazon” overtaking the entire health care industry — as much as the company’s entry into pharmacy distribution, telehealth, and other health industry segments can shake up (potential competitors’) share prices on a day-to-day basis.

Health Populi’s Hot Points: As we continue to forecast and develop strategies to meet health consumers’ demands in and beyond the COVID-19 pandemic, it’s not just “all about Amazon” overtaking the entire health care industry — as much as the company’s entry into pharmacy distribution, telehealth, and other health industry segments can shake up (potential competitors’) share prices on a day-to-day basis.

Brian Owens noted on our call on the evolving wellness consumer that, “health and hygiene will emerge as the next digital.”

Digital health touchpoints are proliferating across the growing health/data ecosystem, from hospital-moving-to-home to virtual health enabled through contactless sensors, recently unveiled by Google’s Nest Hub with sleep sensing.

Another relevant announcement this week came from Doordash, which has delivered over six million meals through its Project DASH during the pandemic — feeling families dealing with food insecurity.

This week, Doordash announced home delivery of COVID-19 test kits from Everlywell and Vault. These direct-to-consumer kits put coronavirus tests into consumers’ hands as part of the company’s larger mission to enable on-demand delivery of over-the-counter drugs from, say, Walgreens along with prescription drugs from Sam’s Club pharmacies. To start, Doordash said that the test kits would be available for same-day delivery in 20 U.S. markets including Baltimore, Chicago, Houston, Las Vegas, Phoenix, and San Diego, among others.

Furthermore, this week Uber said it would collaborate with ScriptDrop to deliver prescription drugs to patients in at least 37 U.S. states (among them California, Florida and New York).

Note that ScriptDrop has contracts with grocery chains and retail pharmacies, along with health systems. This speaks to the importance of collaboration between stakeholders increasingly aligning to meet health consumers’ growing demand for convenience, access, and safe health/care harbors in the pandemic.

And in that vein, as if on-cue, Everlywell announced this week that it would re-brand as Everly Health, acquiring two companies and expanding the concept of “telehealth” to include at-home DTC diagnostic testing…